Your 401K is the issue

index investing is the devil

Your company skims a slice of every paycheck and punts it straight into a market-wide index fund. Sounds responsible, almost virtuous, until you realize how screwed the game is. Barely 61% of US adults own any stock, and only 27% invest in a 401k. Compounding lifts whoever gets on early and leaves the rest trudging behind. If you cannot invest in the public markets, you’re screwed.

When voluntary payroll saving replaced pensions in the late eighties, a new dynamic took hold across every income tier. Public markets and tax-advantaged accounts created an escalator for anyone who could defer pay, but left everyone else stranded on the ground floor. High earners cashed in on pretax contributions and employer matches to accelerate gains, the middle tier treaded water against market swings, and those without access watched their relative standing slip as asset-driven wealth outpaced wage growth. The moment 401k culture went mainstream, each strata’s fortunes diverged: those on the escalator rose faster, those off it stayed put, and the gap between them widened. If you worry about inequality, funding this flywheel with your own savings is like preaching climate action while pumping CO2 into the air.

Even on the escalator the math keeps everyone in line. A typical corporate employee defers six to eight percent, just like colleagues in the next cube. Forty years later the whole cohort retires with balances in the same ballpark and withdraws four percent a year. Nobody leaps a wealth bracket because nobody invested meaningfully more than their neighbor. You stay “fine,” never rich, because relative wealth never budged.

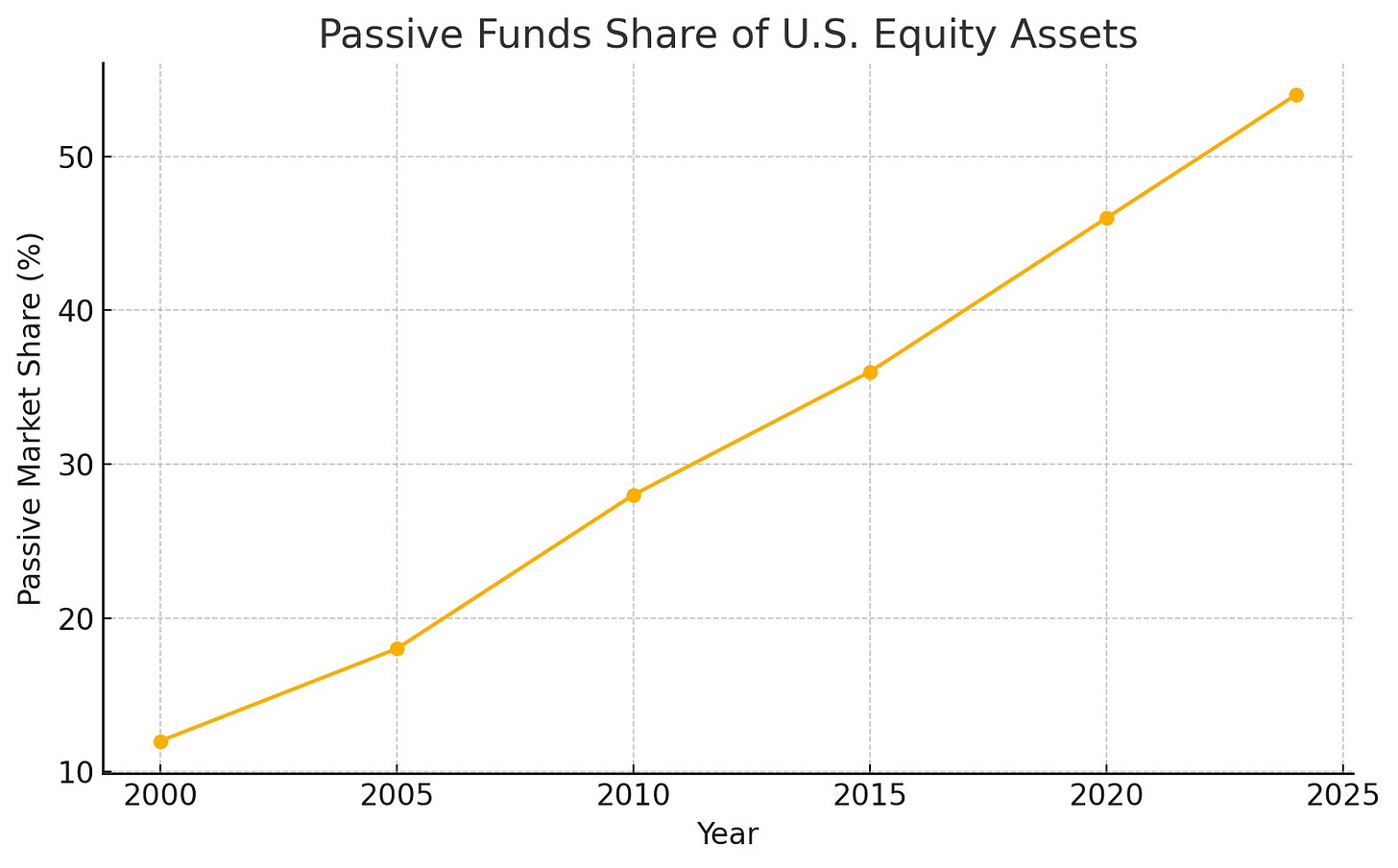

Meanwhile that river of default dollars into the index distorts the very market it is meant to harness. Passive funds now command more than half of U.S. equity assets, up from 12% at the turn of the millennium. Every fortnight new cash buys the biggest tickers simply because they are biggest. Big Tech turns gravity-proof, smaller innovators starve, and price discovery - the moral backbone of capitalism - fails.

So yes, keep contributing if your conscience can swallow it, but stop pretending the 401k is a ladder out of your class or a neutral tool of progress. It is a machine built to preserve the pecking order and to inflate whatever logo already dominates the market. If true wealth mobility, social justice, or capitalism matter to you, look beyond autopilot. Earn more, invest differently, and challenge the way the world works.

-Ajay

Banger. Nice 1 Ajay.